sales tax calculator reno nv

Method to calculate Nevada City sales tax in 2021. This is the total of state county and city sales tax rates.

Sales Taxes In The United States Wikiwand

Ad Manage sales tax calculations and exemption compliance without leaving your ERP.

. Nevada has recent rate changes Sat Feb 01 2020. As far as other counties go the place with the highest sales tax rate is Clark County and the place with the lowest sales tax rate is Esmeralda County. With local taxes the total sales tax rate is between 6850 and 8375.

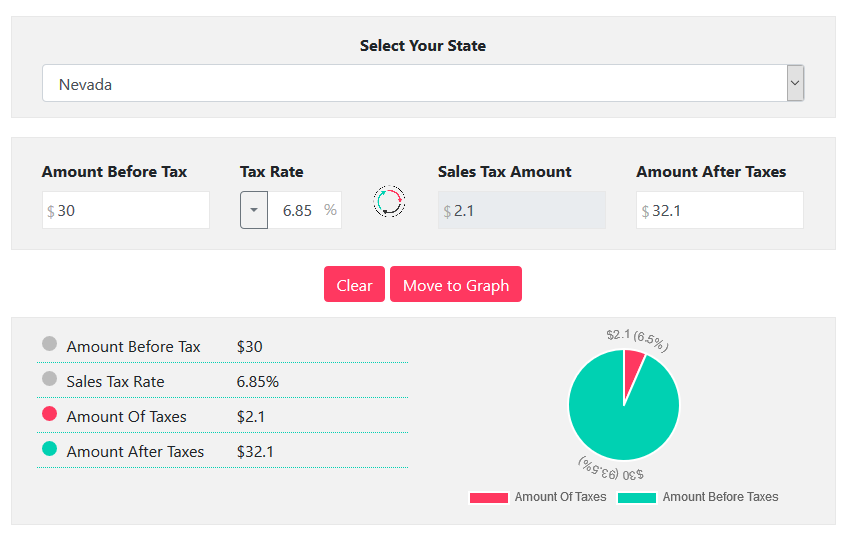

Nevada sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Sales Tax Calculator in Reno NV. The sales tax rate does not vary based on zip code.

This includes the rates on the state county city and special levels. Nevada has a 46 statewide sales tax rate but also has 34 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 3357. For every motor truck truck-tractor or bus which has a declared gross weight of.

Within Fernley there is 1 zip code with the most populous zip code being 89408. The minimum combined 2022 sales tax rate for Reno Nevada is. For auto sales tax calculator nevada more information see Local Tax Information.

Not less than 8500 pounds and not more than 10000. Nevada collects a 81 state sales tax rate on the purchase of all vehicles. Single story open-concept floorplan dazzling c.

Fernley is located within Lyon County Nevada. The average cumulative sales tax rate in the state of Nevada is 795. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Nevada local counties cities and special taxation districts.

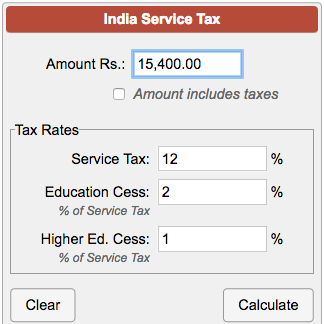

The Nevada sales tax rate is currently. Find your Nevada combined state and local tax rate. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

Tax Attorneys Credit Debt Counseling Financing Consultants. The sales tax rate does not vary based on zip code. This includes the sales tax rates on the state county city and special levels.

The average cumulative sales tax rate in Reno Nevada is 827. Some dealerships may also charge a 149 dollar documentary fee. The average sales tax rate in California is 8551.

NV Sales Tax Rate. Avalara provides supported pre-built integration. The most populous location in Washoe County Nevada is Reno.

Name A - Z Sponsored Links. 4 beds 35 baths 5139 sq. The most populous county in Nevada is Clark County.

The Reno sales tax rate is. 3935 Mules Ear Ct Reno NV 89511 3300000 MLS 220009481 This ArrowCreek sensation has it all. Within Reno there are around 23 zip codes with the most populous zip code being 89502.

For every low-speed vehicle as that term is defined in NRS 484527 a fee for registration of 33. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. The results do not include special local taxessuch as admissions entertainment liquor lodging and restaurant taxesthat may also apply.

The average cumulative sales tax rate between all of them is 825. The December 2020 total local sales tax rate was also 8265. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Reno NV.

As far as other cities towns and locations go the place with the highest sales tax rate is Crystal Bay and the place with the lowest sales tax rate is Sparks. Nevada NV Sales Tax Rates by City R The state sales tax rate in Nevada is 6850. Not less than 6000 pounds and not more than 8499 pounds a fee of 38.

Ad Automate Standardize Taxability on Sales and Purchase Transactions. The current total local sales tax rate in Reno NV is 8265. This takes into account the rates on the state level county level city level and special level.

Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. Integrate Vertex seamlessly to the systems you already use.

Local tax rates in Nevada range from 0 to 3665 making the sales tax range in Nevada 46 to 8265. Select the Nevada city from the list of cities starting with R below to see its current sales tax rate. The average cumulative sales tax rate in Fernley Nevada is 71.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. The County sales tax rate is. In addition to taxes car purchases in Nevada may be subject to other fees like registration title and plate fees.

Reno Back Tax Debt Relief. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The most populous zip code in Washoe County Nevada is 89502.

Reno is located within Washoe County Nevada. The base state sales tax rate in Nevada is 46. Less than 6000 pounds a fee of 33.

For vehicles that are being rented or leased see see taxation of leases and rentals.

89512 Sales Tax Calculator 2022 Investomatica

Taxes Calc Cheap Sale 57 Off Pwdnutrition Com

Nevada Sales Tax Guide And Calculator 2022 Taxjar

Nevada Income Tax Nv State Tax Calculator Community Tax

Nevada Income Tax Nv State Tax Calculator Community Tax

Nevada Sales Tax Small Business Guide Truic

89512 Sales Tax Calculator 2022 Investomatica

Nevada Income Tax Nv State Tax Calculator Community Tax

Sales Taxes In The United States Wikiwand

Nevada Sales Tax Calculator Reverse Sales Dremployee

Nevada Income Tax Nv State Tax Calculator Community Tax

Taxes Calc Cheap Sale 57 Off Pwdnutrition Com

How To Calculate Cannabis Taxes At Your Dispensary

Taxes Calc Cheap Sale 57 Off Pwdnutrition Com

Taxes Calc Cheap Sale 57 Off Pwdnutrition Com

Nevada Income Tax Nv State Tax Calculator Community Tax